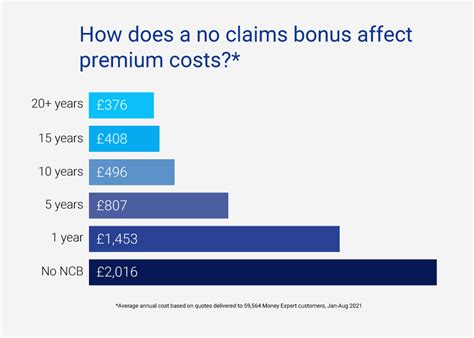

no claims discount proof - no claims discount database : 2024-11-01 no claims discount proofA no-claims bonus can earn you a discount on your car insurance premium by proving to an insurance provider that you’re less of a risk to insure, based on your claims history. Each year that you drive but don’t make a claim on your car insurance, you’ll be . no claims discount proofJika kita melihat jarak yang tidak beraturan, gangguan, atau pola yang tidak sejajar sepanjang jahitan, kemungkinan besar itu tas LV palsu. Penting juga untuk mengetahui desain-desain terbaru tas incaran kita, termasuk dalam hal logo.

Applicable To. Diastolic left ventricular heart failure. Heart failure with normal ejection fraction. Heart failure with preserved ejection fraction [HFpEF] Code Also. end stage heart failure, if applicable ( I50.84) Type 1 Excludes. combined systolic (congestive) and diastolic (congestive) heart failure ( I50.4-)

no claims discount proofHow can I get proof of my No Claims Discount (NCD)? To request proof of your NCD, log in to My Account and start a new chat. From here, select ‘Documents’ followed by ‘NCD . A No Claims Bonus (NCB), also called a No Claims Discount, is an important thing in the world of motor insurance. It rewards you for safe and careful driving, and it can have a direct impact on the .

no claims discount proof

What is protected no claims bonus for car insurance? You can pay to guarantee or protect your NCB. 'Guaranteed' means a claim won't reduce your bonus but you won't get extra discount that insurance . How do I get proof of my no-claims bonus? Some insurers may ask for proof of your no claims bonus while others will check this online using data on claims made. If you’re asked provide proof of your . No Claims Discount (NCD) rewards drivers who haven’t had a claim against their insurance policy for a certain period of time. Learn how NCD affects your premium, how to protect it with Zego, and .When a no-claims discount is calculated, insurers will typically only look at the policyholder’s driving history and how long they’ve gone without making an insurance claim. . When an insurance policy is due for renewal or has expired, proof of a no-claims discount will be available from the provider, to be considered by a different .A no claims bonus (NCB), or more correctly a no claims discount, is awarded if you don't claim in the latest policy year. Even if you have an accident that wasn't your fault – you're hit by an uninsured driver, or . Key takeaways. To get proof of your no-claims discount, you need to contact your previous car insurance provider and request a letter confirming your discount.. The insurer will usually require you to request this information within a specific timeframe, typically ranging from 7 to 28 days. Drivers that have secured a one year no-claims discount (NCD) typically save £745 or 32% on their car insurance premium, according to research from Compare the Market. . A NCD isn't a loyalty scheme - you can usually transfer it to another insurance company by providing proof in writing. .

Atjaunināts: 07.12.2022. ATA karnete un tās darbības principi. Valstis un teritorijas, kurās var izmantot ATA karneti. Preces, kuru pagaidu izvešanai/ievešanai, izmantojama ATA karnete. ATA karnetes saņemšana un izmantošana. ATA karnetes noformēšana muitas procedūru un reeksporta piemērošanai.

no claims discount proof