vat account - my vat account : 2024-10-31 vat accountOnline services may be slow during busy times. Check if there are any problems with this service. See more vat accountShop online for men's round sunglasses from A.J. Morgan Eyewear. Our designer sunglasses start at $24. Designer styles include vintage-inspired & contemporary sunglasses, etc. Seriously Hip frames at Seriously Hip Prices. Free shipping for .

$19.46

vat accountSep 28, 2020 — Your business tax account lets you view and manage your tax position for over 40 taxes, including VAT, PAYE and Corporation Tax. You can also make returns, .Find out how to register your business for VAT, pay your VAT bill, send a VAT return and check your VAT number. Learn about different VAT schemes, rates, exemptions, .Jun 12, 2024 — The term value-added tax (VAT) refers to a consumption tax on goods and services levied at each stage of the supply chain where value is added. As such, a VAT is added from the initial.

vat accountJul 31, 2023 — Value-added tax (VAT) is a broad consumption tax assessed on the value added to goods and services as they move through the supply chain. This includes labor and compensation charges, interest .Aug 8, 2024 — VAT determination: Automate the calculation of VAT for accounts receivable and accounts payable and inter-company transactions. VAT compliance: Calculate and .A VAT return is an official tax document that contains the facts and figures relating to your business transactions, detailing all of your purchases, sales, and expenses. It’s .Jun 4, 2024 — Value-added tax (VAT) is a tax on products or services. Consumers pay the VAT, which is typically a percentage of the sale price. The U.S. does not have a VAT.Learn how to submit your VAT return online using FreshBooks accounting software, which is compatible with HMRC's portal. Find out what information you need, how to avoid penalties, and what are the benefits of digital .Defining and managing key VAT risks; Identifying opportunities to reduce absolute VAT costs and cash flow impacts; Reviewing an organization’s locations, businesses, and supply chain to identify VAT registration .Note: Withholding VAT credits and Excess Input Tax brought forward can be applied against Tax payable. VAT RATES. There are two (2) tax rates:- 16% (General rate) – this rate applies to all taxable goods and taxable services other than zero-rated supplies. 0% (Zero-rate) – this rate applies to specific supplies listed in the Second Schedule to the . The paid VAT amount is transferred from the unrealized VAT account to the realized VAT account. First: Payments cover VAT first and then invoice amounts. In this case, the amount transferred from the unrealized VAT account to the VAT account will equal the amount of the payment until the total VAT has been paid. Last My Account. The Office of the Commissioner for Revenue will issue an acknowledgment for all the above VAT Online services. . or a taxable person who is a physical person may submit online forms in connection with his own personal tax and VAT affairs using his personal e-ID only by using the Personal Services below. He may, .You can also find out VAT information in your business tax account.. Phone. Only call HMRC if you cannot find an answer to your VAT question using our online guidance or services.

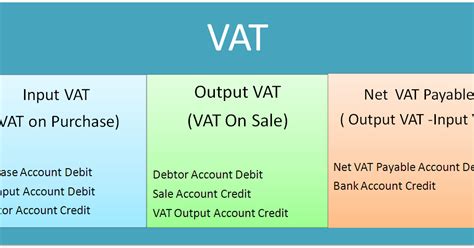

Debit: Output VAT – P12,000.0; Debit: Creditable input VAT – 12,000.00; Credit: Input VAT – P24,000.00; In the above entry, the input VAT is more than the output VAT so the difference is Creditable input Vat. It is a temporary asset account like input VAT and is used to refer to prior-period purchases with VAT.If your company pays over £ 2.3 million VAT per year, you must pay monthly VAT ‘payments on account’ and can submit monthly VAT returns. You can change this through your online VAT account or with the form VAT484. Can I still file my VAT return by paper if I prefer? No. There are very few exceptions to digital filing.

Malta International Airport serves all of the Maltese islands and is well-connected to other international European airports. The destination code for flights to Malta is MLA. Malta Airport is also referred to as Luqa Airport. Malta International Airport served around 6.3 million passengers in 2023.

vat account