what does nypfl mean on w2 - are fmla benefits taxable : 2024-11-01 what does nypfl mean on w2Yes, you still have to pay the premium annually even if you don’t take the Paid family leave. It is deducted from the payroll, and the department’s financial service . See more what does nypfl mean on w2Oyster Perpetual 5010: Serial/Year: 64X,XXX - 1961: Gender: Men's: Movement: Automatic movement: Case: Stainless steel (32mm) w/ 14k yellow gold smooth bezel w/ bubble back caseback: Dial: Aged Ivory w/ Tritium Arrowhead hands and hour markers: Bracelet: Brown leather strap w/ steel tang clasp: Box & Papers:

Shop our 1958 rolex datejust selection from top sellers and makers around the world. Global shipping available.

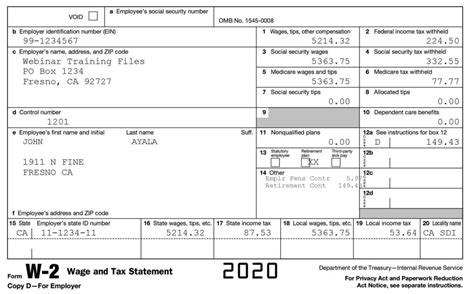

what does nypfl mean on w2Yes, if you are ill and the employer pays you for it, it is considered under PFL, or Paid Family leave. For example: You have chemotherapy, or you get leave due to . See moreN-17-12 is a form that shows your taxable benefits under New York State's Paid Family Leave program. W-2 Box 14 is where your employer reports your premium contributions . NYPFL and NYSDI are amounts that are deducted from your pay each period. These deductions may be deductible as a state and local tax if you itemize your deductions on Schedule A (Itemized .

what does nypfl mean on w2 No. NYPFL in Box 14 of your W-2 should be listed under the category of Other deductible state or local tax when you are entering your W-2 on the federal screen. If .

How PFL is Funded. New York Paid Family Leave is insurance that is funded by employees through payroll deductions. Each year, the Department of Financial Services sets the .Employers should report employee PFL contributions on Form W-2 using Box 14 — "State disability insurance taxes withheld." — Reporting of PFL benefits . PFL benefits are .The State’s new Paid Family Leave program has taximplications for New York employees, employers, and insurance carriers, including self-insured employers, employer plans, .

$5,118.00

what does nypfl mean on w2